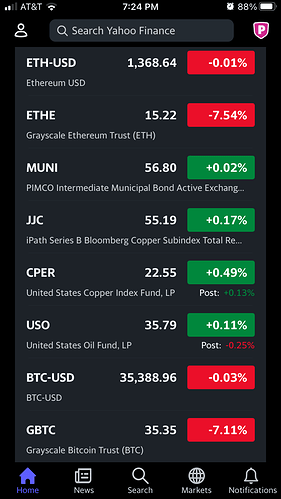

Case in point. Some wacky ETF volatility today relative to underlying. Look at the top and bottom. That is one of the best things about comics. I like that keys (not key collector hype books) have given me big appreciation and little volatility. UF4, DV3 (Aphra 1st), etc. Those are my bitcoins, minus the blockchain, encryption and mysterious founder.

It’s the premium to NAV (natural asset value) gyrating around and also the 8 hour vs 24 hour market cycle. It’s not an ETF. It’s a trust.

https://ycharts.com/companies/GBTC/discount_or_premium_to_nav

Edit: holy moly the premium on gbtc is down to 8% today! Great day to buy

In my opinion there are 3 driving forces when it comes to price action with crypto.

-

Whales - they can take you out whenever they feel like it and often do.

-

Chaos - The original bubble back in 2017 started due to the hyper inflation in Venezuela, followed by mania created by main street media and subsequently crashed by the whales.

-

A hedge for inflation.

Right now the whales are getting fat. Inflation in theory should begin to rapidly increase, and there is chaos everywhere.

Considering most of the crypto assets have experienced 1000% gains since the flash crash back in March, I would be very nervous holding any crypto right now.

If the vaccines work, chaos will subside, money printing will relax and the whales will jump.

Just my 2 cents.

Good analysis! I think this time is different. Crypto dropped with the pan sell off in March. That was chaos. It still tanked. The fed is using this virus as an excuse to buy up everything. Once the treasury and the fed coalesce the money printer will never stop brrrrrrring.

Just my .02

You’re probably right, they almost can’t stop printing with 30 trillion in debt. A low interest rate environment can assist, but 30 trillion is 30 trillion.

What I worry about is the gold backed Chinese State crypto currency over taking the dollar as the world reserve currency.

We all will wish we had crypto if that happens.

This all sounds like pig latin…

Dominance of the dollar is falling fast as international medium of trade. China and Russia already buy oil using Yuan… the petrodollar goes and the US dollar goes with it

Edit: after some reflection, at this point, I’d rather own minty toys and comic books than dollars

I have a bunch of ripple that’s almost worthless at this point

You didn’t sell??? I got rid of mine when it went below .38

It’s not a major investment, so I figure I’ll wait it out at this point.

POLKADOT, baby

“Bitcoin slumps 10% as pullback from record high gathers pace”

“ During a Senate hearing on Tuesday Janet Yellen, Biden’s pick to head the U.S. Treasury, expressed concerns that cryptocurrencies could be used to finance illegal activities.

“I think many are used, at least in a transactions sense, mainly for illicit financing, and I think we really need to examine ways in which we can curtail their use and make sure that money laundering does not occur through these channels,” said the former chair of the U.S. Federal Reserve.”

Well, no shit Janet. People have been saying that for years…

Money Laundering is government speak for “we aren’t getting our cut.” It all comes down to taxes and the avoidance of same. Crypto, $100 bills, heck just cash in general is all demonized as a tool of “illegal activities” merely because the government can’t easily track it and tax it. The inevitable government intervention by either the US or China will burst the crypto bubble. They’ll either ban it or usurp it.

IKR?

It’s already banned in China.

Thank you for your input! Why polkadot?

Can’t ban crypto! It’s decentralized. They’ll just look weak if they try

She clarified her position after causing all the FUD

Notice Blackrock jumped in the pool at the same time? Interesting…

Also heard one of the largest hedge funds in existence is buying this dip starting last night…

Can’t ban? Really? Ban in the since to stop a decentralized blockchain, no. But the Feds could simply make it illegal for US citizens to own crypto just like they once did with gold. More practical method, they just revoke operating licenses for exchanges like Coinbase and make it a crime to deal in crypto. Could you still find a way to convert it to cash…sure but you’re back to ways of pre-2013 when it wasn’t as mainstream as today and made so easy & simple for the masses that are driving today’s market. Don’t miss those days.The SEC could halt the trading of futures contracts. So on and so forth. Improbable sure, but not impossible. No matter how decentralized, a hostile federal government could cripple it to the point it becomes worthless.

Heck, China could simply outlaw mining which still accounts for 50% of the worlds mining. Or the environmentalist greenies are already becoming louder in their outcry over the ever growing power requirements of mining.

Just saying it’s not all rainbows and unicorns.