Just got notification of a tax document available from ebay. There’s a 1099K there for 13K

We know how much you sold last year on eBay now… muahahahahaha!!!

Unfortunately, I am one of those Virginia suckers…

and @agentpoyo - I’m transparent - nothing to hide here (other than from the IRS) … well, maybe from my wife.

I already got mine in the mail and email.

well, all 1099s and w-2s are required to be distributed by today. So if you didn’t get one you’re likely not getting one.

I downloaded H&R Block last night. going to bang it out this weekend.

1099s need to be postmarked by today, not received. So, you still could get one from vendors over the next few days.

Yes, however electronic ones like eBay ( and I’d assume

mercari) would need to post today.

I didn’t get one; but I didn’t sell a thing. Not a thing. Not a thing. All year. Not a thing.

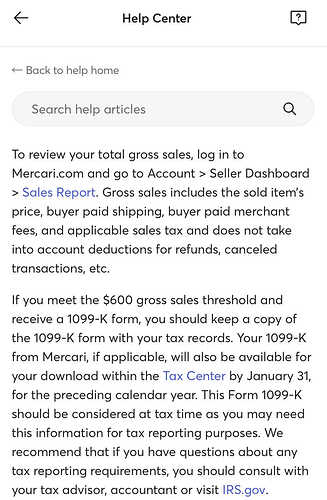

Where is the actual tax info on Mercari? I cannot find crap on the site

Not sure you can get there through the app. May have to log in under a classic browser.

I found my sales report through typing “tax” in their help section, and going to the sales report link provided.

I didn’t meet the threshold so I don’t have a 1099-K, but can still still download sales for 2022.

I did the sales report. Guess that is going to have to do

I assume you can’t find your 1099k?

If they generated one it’s supposed to be there. And by law they’re required to for Maryland sales over $600 gross.

If you’re over that they messed up.

If you’re under, yes the sales report is all you’ll get from Mercari the way I understand it.

I’m still using Mercari, but I really loath how unclear some of their help features/direction is. I lost $200 in a sale because something got damaged in shipping and I misinterpreted the process to get reimbursed. And they’re like “sorry, you clicked the wrong button and now we can’t do anything for you! Have a nice day!”

I also struggle to sell things there, even if I offer the same thing on eBay for 10% more eBay still sells before Mercari every time.

And don’t get me started on their search feature.

Ok, this is turning into a Mercari rant…probably already a thread for that….

I still list on Mercari, get a lot of likes and lookers, and then the books sell on eBay.

I dunno, it seems pretty dead.

Mercari is pretty awful. Their searches are laughable. I’ve bought a few things but will stick with eBay for sales. They could be fined for not getting you a 1099 postmarked by the end of January.

I currently up’d a lot of my prices on eBay. Why?

A lot of people on eBay are getting there Tax Refunds/Returns and impulsive buying.

Also, I chose to donate 10-15% of my sales to Charity. (Arizona Humane Society) where I rescued my Dog, Coach from.

My ‘Street Fighter’ 1:10 variants have been selling well as of late, but I’ve hit the $410 threshold.

I’m dangerously close to my $600 sale limit!

Sell. Make Money. Pay Taxes

![]()

![]()

![]()

Why are you specifically worried about the $600 limit? Even if they don’t report the income to the IRS, you’re still legally obligated to pay taxes on the money you made if it hits $600 or not.

The charity donations you can deduct from the tax bill though when all said and done.

I’m with @CRUZZER

Limit to $600. Just a random number that sounds good.

Maybe I did the same; maybe not.

$600… the threshold where the government cares/doesn’t care if you’re breaking the law!