This is probably why all these places are ripping front covers off their unsold exclusives and “donating” their unwanted product.

They should still be able to claim the buys if it’s made the current year.

Yes they will be able to claim it as inventory and a charitable donation.

Yup, which basically balances out the purchase more than likely to cut losses.

So I could claim my buys as inventory, turn around and donate to charity. Then add those donation numbers up with the inventory? Like double dipping?

Sort of but should balance out as if you bought nothing to begin with.

Basically any money selling comics I make goes right back into buying more comics, so my taxes shall reflect this. Hopefully will be straightforward.

My only advice is anyone relying on this topic for tax advice should probably talk to an actual accountant who has experience with these types of things.

But she should report her sale and pay taxes either way. This law doesn’t really change anything. You’re always supposed to pay your taxes.

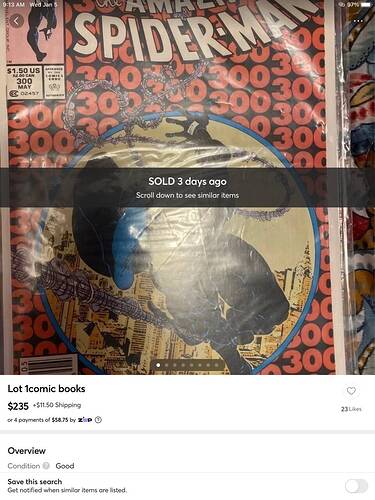

Between more and more states setting up nexus laws for online sales tax, and now payment providers/marketplaces reporting sales at the lower threshold, I’m curious to see what it means for online sales in the future. Will convenience be enough for people to keep buying online? Or if local shops/sellers manage to start being able to sell below eBay, Mercari, Marketplace, etc. prices will it start going back to more people doing things like selling at garage sales or local pop up events vs saving things for online?

yep yep yep. This is precisely the question I’ve been asking. There’s many on every forum with the "you should be … ", but “you should be …” doesn’t translate to “will”… until 2022 now

That said, I too am curious as to the impact on online sales vs. local.

At some point the ease of selling on an online platform, as the “you should be…” changes to “you must now”, becomes such an ass-ache that local becomes easier. I know a few people who are there already

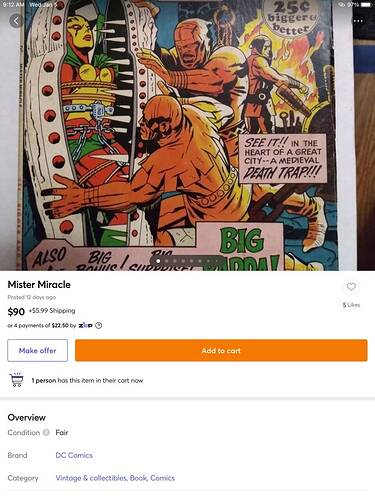

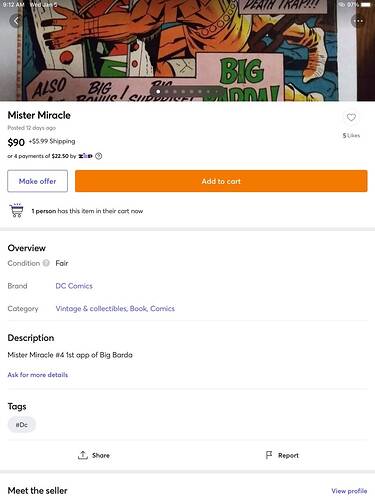

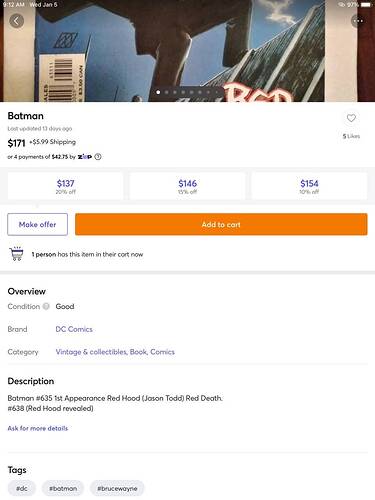

I suspect you’ll still see high dollar things and niche stuff online because the local audience for those is always small. What we may see less of are the people selling cover price comics or cheap $5-10 things as a regular side hustle. I know a lot of folks who have kept track every year in the past and sell things on eBay up to like 19500 in sales specifically to make money and not have to pay taxes on it. Those types of sellers will be gone so what it does to the marketplace will be interesting to see.

damn, already sold $160 on the bay…

stuff i posted long ago that I forgot about…

time to find a new spot…

I’ve been seeing people list their stuff to sell as just comic book in the title they will put what the book is in the description but not the title. Reasoning being you can get around the claiming things as inventory if they over a year purchased. You can just take any new comic receipt and say that invoice was your cost for whatever old comic you sold because on your sales report it just shows the title of what was listed and sold. So your whole report will just say comic book and not a actual title to match up with whatever invoice you claim as inventory.

Can you link to an example? How would anyone find the book in the search results?

Because the search also scans your description not just the title so it still comes up in searches at least that’s how the search works on Mercari I’m pretty sure eBay is the same.

Why would someone need to do this? I could be wrong, but I don’t think the comics comics need to match on sales report and invoice - I think it’s more about the dates.

You sold X dollars worth of comics Jan 1st, 2022 - Dec 31st, 2022

You spent X dollars on comics, supplies, fees etc. Jan 1st, 2022 - Dec 31st, 2022

You only can claim inventory of stuff that was bought and sold within a year. So if you bought $5000 worth of comics this month and don’t sell any of it within a year you can’t claim anything. The misconception going around is you can just claim whatever you buy as inventory and that’s somehow going to save people at the end of the year. Only stuff that sells can be deducted. So if people just put Batman on their listing title and that’s what shows up on your sales report they can use a receipt for any Batman purchase they’ve had in the past year doesn’t even have to be a comic could be a toy or statue or bed sheets and be deducted.

Exactly… this exactly… which is why I look like, feel like, and am as aggravated as Heat Miser for the last 9 months.

That’s not entirely accurate to my knowledge. Read this, it’s a good read on what you can and can’t do: What Small Business Owners Need to Know About Inventory Depreciation

One key phrase in this that I think basically nails down comic inventory:

“When you buy inventory, you can’t deduct the purchase right away. Instead, you subtract the cost of goods sold from your revenue when you make a sale, which lowers how much you owe in taxes. If you buy chairs wholesale for $50 apiece and sell them for $100, your taxable profit is $50.”

Basically, if you’re just a collector who buys comics and then sell them on the side without running a legit business, you’re gonna have a hard time claiming these under the depreciation rules, etc.

If you’re a big time collector and buying high priced books for investments, you can probably lump these under capital assets which you’ll be better off when it comes to paying taxes.

The big thing you have to consider is, do you qualify to claim inventory or not. If you’re a business (LLC, etc) or just a collector not running an actual business, it’ll make a difference because if you’re just a collector who also “sells” comics online, you’re gonna have hard time proving you’re buying comics to only sell as you’re likely collecting as well.

But seriously, talk to a tax professional. That goes for everyone.