I made sure I saved my receipts from 1979 & 1980 when I bought the books I sold.

I’m sure everyone has saved their receipts from back then

unfair jackass feds

I operate as a cash in cash out business. All my purchases count against this years sales. Problem is when you don’t sell the book within the same year, you already got the deduction for it. Books that I have had for years and years I don’t get a deduction for. Sucks but nature of the beast.

Yeah, doesn’t quite work like that but you do you… ![]()

There’s sooooooooooooooooo much that is desired to be said, but … unfortunately, I just can’t do that on a public forum with potential nefarious eyes.

Therefore I’ll just call them unfair jackasses, and hope I don’t get indicted on jaywalking if they see it.

The problem is I think the whatever extra international fees the buyer is paying, it’s not provided in any of the reports I run but is added into the totals.

So my concern is not being able to “prove” the extra amount is not “profit.”, but a fee I did not collection.

I’ll show any example a little later…

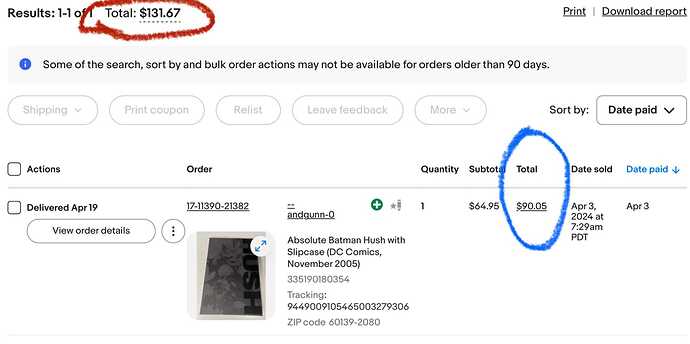

Here’s one example. This is what shows up in seller hub under managing orders.

Note the total circled for the time period circled in red (one day, one sale) versus the total for the books sold on that day circled in blue (one book in the order). There is a $41 difference!

When I export sales data the $90 amount is what is provided in the “total sale” column…and the $41 delta does not appear anywhere in the data. So I’m hopeful (![]() ) the $90 amount is what would contribute to the total on a 1099k from EBay, and not the $131. I can only “speculate” what the additional $41 is…I cannot “prove” anything as other than what I showed you eBay doesn’t appear to disclose what this amount is. It just appears in the total on that screen.

) the $90 amount is what would contribute to the total on a 1099k from EBay, and not the $131. I can only “speculate” what the additional $41 is…I cannot “prove” anything as other than what I showed you eBay doesn’t appear to disclose what this amount is. It just appears in the total on that screen.

I have a discrepancy like this for every foreign sale this past year. I’ll be withdrawing from the global shipping program until it’s clear whether I have to account for this on a 1099k or not.

I could call eBay, but I have no confidence any rep will know the answer given how ambiguously they define gross sales and what is/is not deducted (it basically says nothing is deducted…it’s what the buyer paid).

Bottom line, if eBay includes customs and international shipping fees in what they report to the IRS, then those figures should have a dedicated column within the reports we generate to do our taxes. It currently does not.

In the end, you should have a final report of what they’ll send to IRS, just make sure that’s accurate with your own record keeping. I wouldn’t go by what they display on their site and other reports. The year isn’t over yet, always wait for the actual 1099 they provide.

I get that. That’s why I’m in a wait and see approach, and just making people aware of these two amounts not matching up.

I do suggest others if you have had foreign sales through eBay global shipping this year to take look at the total circled in red under “orders” for the year to date and see if it matches the total under other tabs, like “performance.” I’d be curious if others see a difference as well.

You can identity which ones these are by exporting the data to a spreadsheet and there is a global shipping column…these line items will have a “Yes” in that cell.

If anyone has a 1099k from last year, and sold through global shipping, it would be much appreciated if you could confirm whether the total included any customs or foreign fees paid buy the buyer in the amount. I have not qualified for a 1099k in years past so I can’t confirm this myself.

Global shipping has two shipping fees charged to the customer. The fee for you to send it to eBay and the cost of eBay to send it to the end buyer. I am thinking this is what the difference is (this would any taxes or vat included)

Question for you guys, I’m wondering what’s the reason on the insistence of using Ebay’s global shipping program? You realize it’s one big scam from Ebay to charge even more fees to both the buyer and the seller (because Ebay is taking an amount of your total sale including the exorbitant shipping fees). It’s actually costing you some international sales because people like me will never make a purchase from a seller that is using the ebay global ship.

When I make a sale to the US, UK, Austrailia etc, printing out the shipping label is all the same. All the information is filled out, all I need to do is weigh it and fill in the package dimensions. I never have to fill out customs information or anything like that, takes me seconds so I don’t know what you’re actually saving time from.

You get the convenience that if something goes wrong ebay takes care of it but that comes at a cost. Out of the 1000s of international orders that I have sent out of Canada, I haven’t gotten into a scam issue not even once. So the idea that you don’t want to deal with a scam situation is extremely low. Ebay preys on that mindset. Truth is you’re probably more likely to get scammed domestically because an international buyer who’s willing to pay extra for the high shipping cost wants the item.

You can choose which countries you want to send it to. When you send it to ebays global shipping center they have to open the package to make sure the contents are correct. What they will also do is remove some packaging so the package will be lighter and thus be cheaper for them to ship (I learn this from reading comments in their community forum). It’s one giant scam.

Businesses like Mycomicshop on ebay don’t use ebays global shipping so their shipping to Canada is so much more cheaper. I’m talking half or more.

I think it is the seller protection portion of it that makes it worth while.

Back in the day there was a big international scam where people would buy off eBay (especially trading cards) and would claim they never arrived or were sent the wrong thing.

This leaked over to comics as well.

I bought a box set of Rick and Morty and sold the ash can that came inside of it. It was the left 3 staple copy and the box set was purchased from Target.

When it got to Canada it suddenly became the two staple copy and the buyer claimed I sold a bootleg item. The copy they sent back to me was a photocopied two staple knock off.

eBay sided with the buyer and I was out money plus the international shipping costs to and from.

I guess I would feel differently had I been scammed in the past and would taint how I feel. Truth is bad apples can happen anywhere. When I send out a copy of Ultimate Spider-Man 1, the buyer can always easily claim they didn’t get it even with delivery confirmation or was sent a damaged item. It’s always a risk when you send anything out.

I’m just looking at the low percentages of sales that actually turn out to be scams (international or domestic) and that number is so low that it’s something that I will never really worry about.

Maybe it was more prevalent in the past so it was something to consider, nowadays it just isn’t an issue for me.

I can second what SpicyWasabi is saying, I rarely buy a comic from US if it is using the Global Shipping program. It is cheaper to get comics from the UK than from the US which I find pretty crazy. There are scammers domestically as well but I think maybe it feels like you have more recourse in your home country. Also, it is not like Canada is a giant market, so I understand when sellers will trade slightly less sales for more assurance they won’t be scammed.

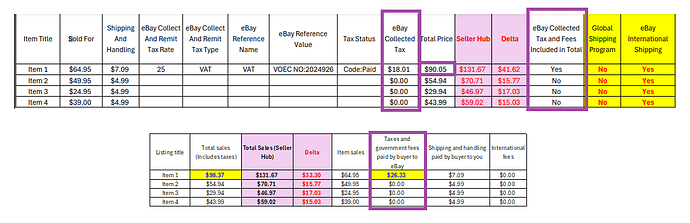

VAT shows up in the data reported. You can see it’s 25% of something for Norway…I’m not sure what total 25% is taxed to.

But that seems to make the data. What it doesn’t do is account for other unknown costs by the seller. Although I’m questioning whether EBay actually “collects” these costs, or if they’re just “paid”. If they do, it’s not showing up on the reports as such. See below (and follow me down the rabbit hole a little further).

I know this is a bit confusing, but these are two summaries that can be exported from ebay seller hub…I’m also showing a few more sales to identify some trends. The top is an “Orders Report”. The bottom is a “Listing Sales Report”. I added the “Seller Hub” and “Delta” columns in purple to highlight the discrepancies…(these are not columns in the reported data).

In the Orders Report, its’ odd that nothing is ID’d as “global shipping program”, but they all were international shipping. I don’t ship other than through the global program. So I find that strange. It does show what EBAY collected for tax for Item 1 ($18.01), and you can see VAT was applicable. Total price was $90.05. The other three items it was not, and ebay apparently did not collect any VAT.

Now go to the Listing Sales Report, and you’ll see under total sales the item is now $98.77. And Taxes and “Government Fees paid to Ebay by the buyer” is $26.33. This is not consistent with the table above…so it must be government fees amounted to ~$8…one report provides it, the other does not.

I guess I can only assume EBAY is not collecting those additional fees from the buyer, otherwise they should show up in one or both of these reports. Why these other fees paid by the buyer are added to the total order elsewhere in seller hub (without definition) is unknown, but hopefully they don’t get included in the 1099K total. Otherwise Ebay has to disclose that to us in these reports (I’d consider it fraud if they did not).

Hopefully this helps others be informed of Ebay’s shortcomings on this topic. I’ll be keeping tabs on it and probably bring it up again when the 1099s come out. Otherwise there’s not much else that can be done.

Is the $5k not $600 grace year still happening for 2024? That means eBay won’t send one if sales are under $5k for this years’ sales. The $600 starts for 2025 sales.

$5000 in 2024. Correct. I am well above that so it doesn’t effect me.

Depends on your state. The IRS limit recommended is $5k for 2024. However there are states like Maryland ($600) that have lower limits, and eBay abides by the more stringent of the two.

Unless congress changes course, the national limit drops to $2500 for tax year 2025. Basically it’s a phased approach for the next few years until it his $600.

I know, I know I know - pay your taxes regardless ![]()

But for the old ladies in the group selling their used couch, old clothes, and other stuff on Ebay, I just Grok’ed this as I thought I heard it this morning:

Yes, the “One Big Beautiful Bill Act” passed by the House includes a provision to revert the Form 1099-K reporting threshold for third-party payment processors like eBay back to $20,000 and 200 transactions per year, effective for the 2025 tax year and beyond. This reverses the changes made by the American Rescue Plan Act of 2021, which had lowered the threshold to $600 with no minimum transaction requirement.

Not entirely sure it’s true; but if it is, the little old ladies are back in business boys!! ![]()

![]()

![]()

![]()

![]()

![]()

That would be nice.

Makes no difference. I always report income.