Does Mercari allow for physical dollar payment? Does it have “local” listings such that one can actually drive to the sellers?

I’m trying to look into every avenue where I don’t need to do electronic payments.

Mercari does local sales but I think the money still proxies through them in order for them to get their cut while also providing all the seller/buyer protections.

Yes they do local but I think a Uber picks up your item and delivers it. The local delivery is something they just started a couple weeks ago.

Question. Is this how you’re doing it now, i.e. just doing your own math and reporting net income?

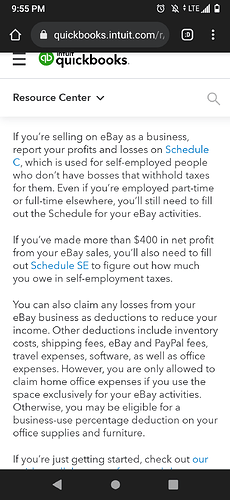

Because ebay is only going to send 1099s and not calculate your expenses for you. So unless you’ve already have total expenses past the (now very high) standard deduction , all those expenses can’t be deducted until your total expenses (property taxes, real estate interest, etc) Surpass that standard deduction.

This is why I’m considering an LLC because as of now if I combine my eBay sales with my personal income I can’t take credit for expenses as I don’t buy enough stock or pay enough in seller/shipping fees to surpass my standard deduction.

But I believe If I open an LLC I can claim all of these comic expenses against my sellers income separate from my personal income (thus the standard deduction does not “consume” or negate my comic expenses).

I just went to a CPA, gave them all my costs broken down in each category, and they let me know what I owe based on the gross. Not sure about the standard deduction part. So you are saying if my costs don’t exceed $12,550 for a single filer, I won’t be able to deduct my inventory?

Where do you deduct it? Wouldn’t it be listed under Schedule A itemized deductions?

No wonder you guys are freaking out. So you thought this entire time that if your expenses doesn’t exceed your personnel deduction, you cant deduct your business related expenses?

It doesn’t work that way at all. A percentage of your home, cell, internet, utilities, mileage for your car, eBay fees, packaging material, postage, inventory, depreciation for office equipment, payroll (if you have any) are all possible deductions that you may employ via Schedule C.

Like I said earlier, for people who are really into this hobby, this change is good because it’s forcing you to look into how this all works and you’re going to find out the benefits of spending a culmination of about 4 hours to execute the steps I laid out above are going to end up saving you a ridiculous amount of money.

Before you do anything, talk to an accountant who specializes in small business.

I would interview a minimum of 3 of them. Go with the one you feel most comfortable with. Ask all of them about an LLC versus a Sole Proprietorship. Ask them about what’s deductible. Ask them about how to handle inventory. Ask them to think of questions you should be asking.

It will be the best couple hundred bucks you’ve ever spent.

Also, on a macro level, I think this change is going to expand the hobby. Not shrink it.

With today’s climate, a lot of people are seeking opportunities to be self employed. Starting a comic business is one of the most attractive and simplest businesses to start.

This change is going to open a lot of eyes. I imagine many of you will go this route once you look into the benefits.

For those that do, they will have significantly more cash flow and discretionary income than they currently do to buy more comics.

Combine that fact with the maturation of the streaming services and all arrows point up.

And as far as the casual collector is concerned regarding their 1099, most aren’t going to care if it doesn’t amount to much. And if does amount to much, they’ll likely look into the above.

Just purchased something today using Paypal through eBay. So I don’t think the payment methods have changed yet.

Purchasing will never change at eBay. They’ll always allow people to use Paypal and other forms of payment. It’s just sellers who have to update to use their own bank accounts linked to withdraw.

I rarely buy anything on eBay since the change to managed payments. If my money was put into an account where I could automatically purchase something on eBay I would probably spend a lot more because I could see what I have and itd be burning a hole in my wallet.

But since it sits there for a while before being processed/releases…then has to go to a bank account…then I have to send it to PayPal…that whole process takes so long by the time it’s in PayPal I’ve already spent it on something outside of eBay…

I don’t even bother sending $ to PayPal anymore. I just pay my credit card balance off with it….

I thought someone here said they changed the payment methods also. Must of been my imagination then lol

Payment to sellers from eBay, but buying stuff they accept Paypal, Credit Cards and most other forms of payments… they would never do away with Paypal to buy things, they’d lose customers.

Ah gotcha. Thanks for the clarification.

What he said

That’s what I basically said as well, way back in comment #3

My advice: drink a V8 first.

Are there websites or other avenues for information that don’t start with “talk to a tax expert”?

I’ve learned all forms of home repair, car repair, filing, fitness, online Will, etc… on my own through extensive reading and through attempting/learning on my own. I’m kinda opposed to talking$$$ to “experts” generally speaking (doctors, dentists excluded).

Further, I’m even more downright indignant based on this b.s. 2022 1099-R. That factors in.

Comments on what should have been done in the past are not necessary; but location of information going forward would be appreciated.

Honestly, not really. I mean, you can always go take a stab at reading all the docs and tax laws at IRS.gov but I don’t think most will want to provide advice unless they’re completely certain on what they’re talking about so it’s normally and sadly, go talk to a tax professional to get the best advice.

I work with a guy who reads tax laws in his spare time and he’s claimed he’s spent countless hours and days learning about taxes and the laws, so if you got a lot of time, that’s really the only thing you can do. It’s complicated and you’re not gonna get most of it by just watching a video like to fix a part on your car… It’s just too bad it’s not that straight forward like most DIY stuff…