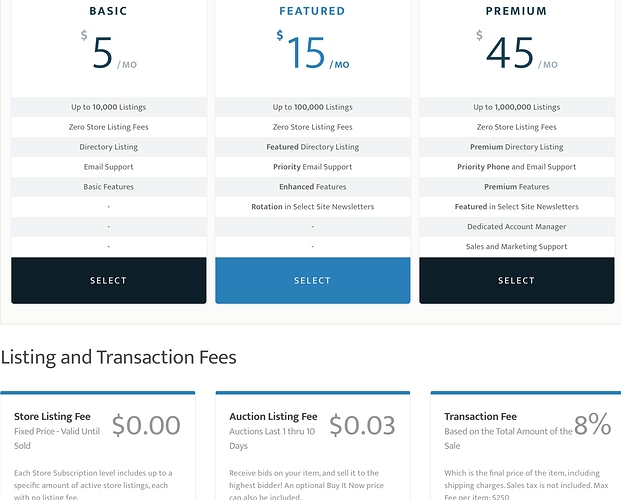

I know some people get tired of the 10% fees on EBay and Mercari, enter Hipcomic.com. Hipcomic has a 8% fee and affordable online comic stores for as little as $5 a month. I’ve been using them for some purchases lately and found some decent deals. It deals only with comics and comic collectibles, no more 2000 items returned in a EBay search with only 5 of them being the comic your looking for. I believe the market place is about three years old and is a continuing to grow competitor to other established back issue online marketplaces.

So, unless you sign up for premium you don’t get phone support? Am I reading that correctly?

Because for email it has basic and priority… but only priority for phone.

I wonder how that works…if you’re basic are you put in a que behind all priority until priority emails are answered? That could be indefinitely. or do they put a time limit and if you’ve waited long enough you’ll,get moved up in the que. or maybe they mix it up…5 priority for every 1 basic answered.

I dont see any info if you dont want to have a store… Do they just charge per listing then? It’d be nice if they had a beginner store thats $0 with like 50 listings per month. That would make it way more appealing and attractive to sellers who dont have thousands of items to sell.

8% fee from a relatively unknown site vs 10% from feebay. The 2% difference, Im sure, would be made up in the amount if traffic that each site respectively gets.

Need to see some comparative sales. It might be a good spot to buy and get a deal, but not sell.

What is their return policy too. I could see disaster for buyers of expensive comics if the site refuses to resolve issues and basically take a “buyer beware” stance.

No doubt the 2% difference or more could be made up due to eBay getting millions of more hits from traffic.

But I’m all for someone to step in and start competing with eBay but sadly, limiting your auction house to just comics and collectibles is very niche, it’s only going to draw in the hardcore comic crowds I think. Those who are not hardcore that buy the impulse buys and not hardcore collectors are gonna stick to eBay cause they likely buy other things off eBay.

I am all for another model to sell comics. Amazon sucks for selling but you can move product. Other than eBay, there isn’t a lot of other places. Comic Mint was supposed to be an alternative to eBay until it became a store for variants.

$5.00 clams a month is not bad for a Basic … especially since the listing is good till cancelled … ebay hits you each time the listing is renewed …

Does anyone know how tax burdens work on these third-party websites? I know eBay sends you information to file if your sales are >$10000 in a calendar year, but otherwise take the tax burden. Or is it all pretty much up to the individual to claim income like this?

This might be nice to sell those lower-priced books. Right now I use Instagram for the cheaper books, but it’s biggest downfall is it’s not searchable and hard to find stuff… maybe I’ll give it a try.

Only if you go over the 50 listing marks… I don’t sell 50 books a month myself. I never pay for listings. If I do reach 50 books, I usually stop when they’re costing me 35 cents per listing after 50.

I could be wrong, but I believe the threshold on PayPal is 20K … states differ, but generally it’s 100K or 200 sales per year per state … you’d really need to be moving some product State by State

eBay only notifies the IRS when you hit 200 and or 20,000k in sales. And that’s actually Paypal since they handle the actual transactions. Paypal business accounts probably report any and all, I’m not sure though since I don’t have a business account with either.

As for when it comes to taxes, if the 3rd party vendor or website sends one to the IRS or not, the burden of your income is always upon you, the tax payer with reported income.

The IRS is pretty lax though if you sell one or two items a year on eBay, if you don’t report that income I doubt they’re going to care. It’s sort of like selling stuff you’ve previously owned at your own yard or garage sale, the IRS says you don’t need to report such income unless you’re making a living by selling stuff out of your garage and it’s your only source of income. Get with a tax professional though cause I’m not one myself and I’m not liable if you take advice from a chicken on the internet.

If you don’t get a 1099 or a 1099-K, I’d say you’re pretty much golden … (I am not a Lawyer, IRS Employee or Affiliated in Any Way, nor do I play one on TV) …

Yup, just hope you don’t get audited, cause that’s when they find those transactions.

Can you make an argument that selling comics on eBay is a hobby and any income you make negated by losses investing in more comics?

For example, if I bring in $5000 in comic sales on eBay in a year, but show that I also buy $6000 in comics doesn’t that sort of negate my net profit?

I sell comics so I can buy more comics…not as a business but as a hobby…I’d have to look at my 1040 but I thought that was ok to claim losses against profits.

While you are correct in that Losses can Offset … it’s a Big Red Flag for an Audit … Gambling Winnings can be offset by Losses as well … another Audit Red Flag …

In addition, you would need to file Schedule C … Profit or Loss from Business (Sole Proprietorship)

Understood, but I’m just saying if I were already under audit due to not disclosing eBay sales I would likely make that argument.

Your Attorney, since you’d need one, could try and make that argument … I’m no expert, but if you never filed a Schedule C to begin with, you’d likely have to amend any past filings, just as a start … likely even if you had filed Schedule C’s they would need to be amended …

Best when confronted by any scenario such as this, to consult a very good Attorney …

I’ve learned from people who have been audited that one should never give the IRS a reason to audit them… I hear it’s painful. If you do a filing to save money but it’s gonna create a red flag, I say just take the loss instead, you’ll save money and time.