I can second what SpicyWasabi is saying, I rarely buy a comic from US if it is using the Global Shipping program. It is cheaper to get comics from the UK than from the US which I find pretty crazy. There are scammers domestically as well but I think maybe it feels like you have more recourse in your home country. Also, it is not like Canada is a giant market, so I understand when sellers will trade slightly less sales for more assurance they won’t be scammed.

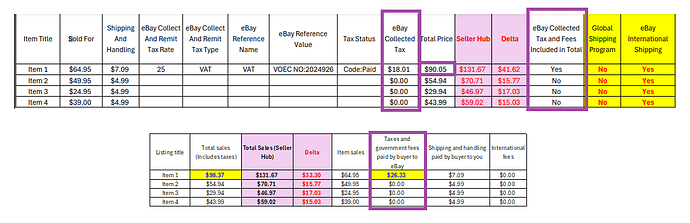

VAT shows up in the data reported. You can see it’s 25% of something for Norway…I’m not sure what total 25% is taxed to.

But that seems to make the data. What it doesn’t do is account for other unknown costs by the seller. Although I’m questioning whether EBay actually “collects” these costs, or if they’re just “paid”. If they do, it’s not showing up on the reports as such. See below (and follow me down the rabbit hole a little further).

I know this is a bit confusing, but these are two summaries that can be exported from ebay seller hub…I’m also showing a few more sales to identify some trends. The top is an “Orders Report”. The bottom is a “Listing Sales Report”. I added the “Seller Hub” and “Delta” columns in purple to highlight the discrepancies…(these are not columns in the reported data).

In the Orders Report, its’ odd that nothing is ID’d as “global shipping program”, but they all were international shipping. I don’t ship other than through the global program. So I find that strange. It does show what EBAY collected for tax for Item 1 ($18.01), and you can see VAT was applicable. Total price was $90.05. The other three items it was not, and ebay apparently did not collect any VAT.

Now go to the Listing Sales Report, and you’ll see under total sales the item is now $98.77. And Taxes and “Government Fees paid to Ebay by the buyer” is $26.33. This is not consistent with the table above…so it must be government fees amounted to ~$8…one report provides it, the other does not.

I guess I can only assume EBAY is not collecting those additional fees from the buyer, otherwise they should show up in one or both of these reports. Why these other fees paid by the buyer are added to the total order elsewhere in seller hub (without definition) is unknown, but hopefully they don’t get included in the 1099K total. Otherwise Ebay has to disclose that to us in these reports (I’d consider it fraud if they did not).

Hopefully this helps others be informed of Ebay’s shortcomings on this topic. I’ll be keeping tabs on it and probably bring it up again when the 1099s come out. Otherwise there’s not much else that can be done.

Is the $5k not $600 grace year still happening for 2024? That means eBay won’t send one if sales are under $5k for this years’ sales. The $600 starts for 2025 sales.

$5000 in 2024. Correct. I am well above that so it doesn’t effect me.

Depends on your state. The IRS limit recommended is $5k for 2024. However there are states like Maryland ($600) that have lower limits, and eBay abides by the more stringent of the two.

Unless congress changes course, the national limit drops to $2500 for tax year 2025. Basically it’s a phased approach for the next few years until it his $600.

I know, I know I know - pay your taxes regardless ![]()

But for the old ladies in the group selling their used couch, old clothes, and other stuff on Ebay, I just Grok’ed this as I thought I heard it this morning:

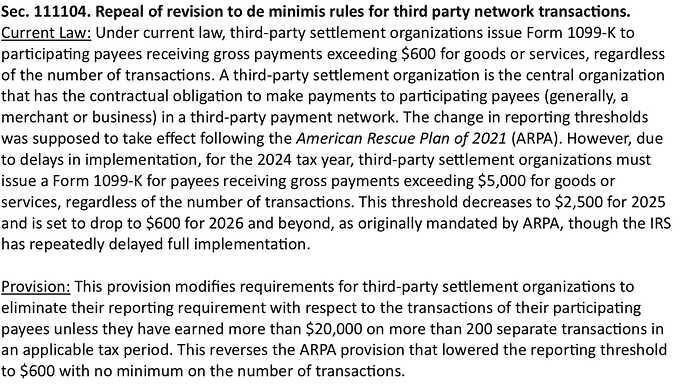

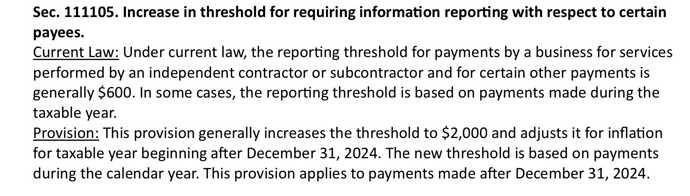

Yes, the “One Big Beautiful Bill Act” passed by the House includes a provision to revert the Form 1099-K reporting threshold for third-party payment processors like eBay back to $20,000 and 200 transactions per year, effective for the 2025 tax year and beyond. This reverses the changes made by the American Rescue Plan Act of 2021, which had lowered the threshold to $600 with no minimum transaction requirement.

Not entirely sure it’s true; but if it is, the little old ladies are back in business boys!! ![]()

![]()

![]()

![]()

![]()

![]()

That would be nice.

Makes no difference. I always report income.

Yup, you don’t want to find yourself in an audit and then have to explain “funds” that you never reported on… and now you’ll owe interest on a great payment plan with the IRS tax man… And if you don’t want to file what’s not reported, don’t publicly talk about it. They’ll find out and you can’t claim “ignorance” and only make it worse for yourself.

The only rule one should talk about taxes publicly is, “I report all my income”… and leave it at that!

This was clearly for the little old ladies in the group who sell their old sofas.

I report all my income

My father in law passed away in December. We started a new eBay account for my mother in law to sell some of his stuff. Cell phones. Cameras. Stuff like that. Not extreme value but things that have some worth. She is 80 and everything is essentially being sold as a loss. Online yard sale essentially. She has surpassed $600. And with no original receipts it is all taxable.

And this is a real world example why that $600 was B.S.

If I may be serious on this finally, $20K is a bit much. It can and will invite those that choose not report.

But the alternative of $600 for reasons like this, is just batshit nuts too.

A compromise somewhere in between would have made a whole lot more sense.

I agree with @Bill . She should not have to pay. Even without receipts you should still be able to claim these are at a loss on IRS tax forms.

Problem is it likely throws up a red flag and even though she is in the right, they’ll give her the rectal exam of n audit anyway.

And that would be wrong.

I actually agree too but the problem is, what turned into the miscellaneous selling of items you are likely selling at a loss (like garage sales, yes the IRS doesn’t care about your 1 or 2 garage sales each year, they know most of the time you are selling off stuff at a loss from it’s original price tag), has turned into a full fledged business for a lot of folks who now sell on sites like eBay, etc. So it’s impossible to tell who’s selling to run a business and who’s just dumping old crap. This is why I think it should be a case by case basis and likely based on how often you sell on eBay or other sites. If you got hundreds of items listed on average each month, month to month, you’re a business. If you sell a hundred or so items once during the year and then you don’t touch eBay thereafter, you should be given a pass on the sales, even without receipts.

Just my two cents…

The little old ladies & grumpy old men are back in business! LOL

(I pay all my taxes. I pay all my taxes. I am not a grumpy old man)

I’ll wait for the eBay announcement before I claim victory for Grammy and Gramps. eBay was all over this (for obvious reasons) so I’d expect them to have an announcement to let people know to not let their forced 1099-k get in the way of people listing items. Since it happened over the holoday weekend probably won’t be until later next week.

I think I’ll also move this discussion to the 1099-k thread as well to keep the history together. So don’t be alarmed when it all disappears here.

OBBBA reinstates the $20,000 and 200 transactions thresholds, retroactive to 2022 (or as if the reporting changes American Rescue Plan Act of 2021 had never happened). That means that the $20,000 and 200 transactions thresholds will apply to the tax year 2025.

I would like to believe Forbes has all the facts, but we’ll see what happens.

I had read the changes didn’t take effect until tax year 2026 with respect to the 1099-k.

Many still might get a 1099-k, because state laws govern over federal. And some states like Maryland have had the $600 threshold for many years.