No I dont grade books so the 9.8 is mute to me. The books are usually 9.4 or better. I’m no grader but other than marvel print errors MY books come in great condition. my photos are all thru this thread I’ve sold books that people got slabbed so they are of good quality.

Just put a small order with PCK Comics. If the shipping is better then TFAW, I might go with them. I just put an order with my shop on Sunday and just got an email that Im not getting my order even though I got an email saying my order was placed. So now I might be on a look out of a new LCS and a new online shop.

What are the rules around charging tax. It seems unknown and midtown don’t charge tax while tfaw and dcbs charge tax. any insights appreciated.

I know when i go the midtown store in NYC i have never been charged taxes on comics. But i have been charged tax on graphic novels or supplies.

I live in NJ so no tax as of yet.

I’m in CA so Im used to paying taxes for everything

Quick google search found this:

A comic book that is published serially under the same title at least once quarterly is exempt as a periodical. … The retail sale of a graphic novel that is in the form of a comic book is subject to sales tax . The novels are not published at stated intervals; they are books .

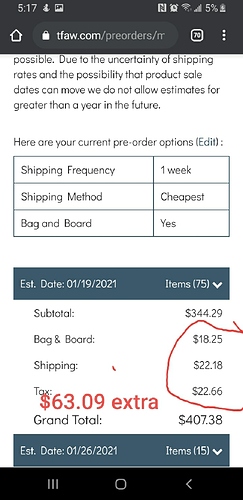

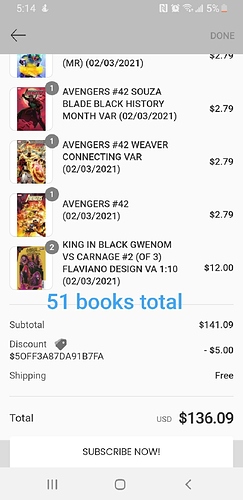

My latest orders Tfaw order has 20+ more books so the weight is higher I assume. But still see the add ins. Makes the 20%-30% off mute with the additional costs. Now Tfaw is still dope…no question. I’m just tryna save more money. And I know Tfaw is my go to for incentives/ratios/etc. But I had to switch my standard order back over. Especially with the discount of %30 even up to the day OF FOC.

I didn’t go on to read more of the pdf though… looks like there’s more stuff that outlines taxes on comics.

You need to charge your phone lol

It actually varies from state to state. Most states require sales tax of some type, but there is even variance on what items qualify by state.

Mycomicshop actually has a section about it.

@SpideyHunter516 has 5 whole % left. He can ride so much closer to the edge! Go get that adrenaline, brother!

Oh I know. I was just pointing out the NY resident who says he doesn’t get charged tax on comics when buying at Midtown in NYC.

This is a great breakdown on taxes for small businesses who are selling out of state on the Internet.

Remote Seller State Guidance (streamlinedsalestax.org)

Most small business won’t have enough sales in most states to charge sales tax to out of state customers.

It’s complicated and varies state by state. Especially since the supreme court ruling a few years ago allowed states to change how nexus laws are set up. If you have an economic nexus in the state, you’re responsible for sales taxes. Some states it’s a huge sale number, some states it’s the number of sales, some states it can be if you have a single employee with a residence in the state.

We use Avalara (I believe) which tracks any changes to laws and updates where we do/don’t charge tax automatically on the back end. Otherwise it’s almost a fulltime job just for someone to monitor every state’s laws and what changes and if you’re required to charge sales tax each year.

It’s been a few years since I’ve been frequently in New York, but from what I can remember if a comic is classified as a periodical (ie a “magazine”) there’s no sales tax, but if it’s a collectible there is a sales tax. So the general rule of thumb was if it’s cover price or less, no tax. If it’s above cover price, tax.

There are some states that had changes to their nexus threshholds in 2020, but this seems largely to be accurate based on the few I know of. I’m obviously not a tax professional haha.

I imagine even more states will update their rules in 2021 now that COVID has caused a huge surge in online orders and local sales taxes aren’t bringing in as much.

You can’t just write “I’m not a tax professional” on your listing. You need to add a grade or pictures for us to really see.

I bet you’re right…

Following up on my DCBS comment upthread. I sent their customer service an email (the only way you can contact them, by the way) and politely asked if I should be concerned. Got an apology a few hours later and a shipping notification. I decided not to ask about the cancelled book they relisted for more money… that got the side eye, but it’s not a deal-breaker.

@nonlinear Did you get a response from them?

Agreed? Are you 9.2 of a tax professional or 9.4 of a tax professional? How much of a tax professional are you?

Yes, what grade are you?